Your Trusted PEO Advisor & Advocate

PEO Experts. We work for you - not the PEO

At iBenefitsHR, we help companies make smarter HR outsourcing decisions by providing expert guidance, unbiased comparisons, and ongoing advocacy—at no cost to you. Whether you're exploring a PEO for the first time or reevaluating your current provider, we bring clarity, savings, and confidence to every step of the process.

/Home%20Page%20Pic%201.png?width=800&height=800&name=Home%20Page%20Pic%201.png)

.png?width=800&height=452&name=Untitled%20(11).png)

HR Consulting Services

We create and manage a fully customized HR infrastructure for your business.

.png?width=800&height=452&name=Untitled%20(15).png)

PEO Advisory Services

Get quotes from top PEOs and expert advice to find the best fit for your business.

Our Approach: Comprehensive, Adaptable, Technology-driven and Human-centric

We assist our clients in attaining outstanding HR outcomes through our innovative yet highly adaptable suite of services and technology, expertly overseen by a committed team of seasoned professionals.

.png?width=800&height=452&name=Untitled%20(16).png)

Comprehensive and adaptable collection of HR, Benefits, and Payroll service modules

Enhance your HR, Benefits, and Payroll workflows with our range of adaptable service modules, providing full flexibility to cater to your specific business requirements.

.png?width=800&height=452&name=Untitled%20(17).png)

Fractional ownership of a team of experienced specialists

Leverage fractional ownership to access the skills of a team of experienced specialists prepared to boost your business to new levels while saving costs.

.png?width=800&height=452&name=Untitled%20(18).png)

Cutting-edge technology

Keep a competitive edge with top-tier technology, enabling you to enhance efficiency, foster innovation, and surpass your competitors in the ever-evolving business environment.

A great company needs a strong people foundation.

In the business world, your People Foundation is the tactical infrastructure comprising the technology, processes, policies, documentation, administration, and support of everything related to HR, benefits, and payroll.

Doing it right requires broad experience, incredible technology, mastery of the fundamentals, and exceptional execution.

At iBenefitsHR, we help our clients build and support their People Foundation.

Foundations are boring… But very important

Your people are the most important asset of your business, so your people foundation needs to be Designed, built and executed with precision from the start.

It isn’t rocket science, but it’s not easy, and too often it’s underestimated.

Getting it right requires a broad skill set, great technology, and expert execution.

Exceptional HR = Business Results

Data show overwhelmingly that businesses with an engaged workforce perform significantly better than their competitors. That makes exceptional HR a must-have for all businesses that hope to compete and thrive.

But nothing great was ever built on a flimsy foundation… so you first need a strong foundation for your business's people to function.

/Engaged%20Employees.png?width=1366&height=768&name=Engaged%20Employees.png)

Build a strong people foundation

Whether you're a startup or a large enterprise, our comprehensive HR solution offers you partial access to a full team of experienced specialists, ensuring that every aspect of your HR, benefits, payroll, and HR technology operates seamlessly and effectively.

/Evolving%20Business.png?width=800&height=800&name=Evolving%20Business.png)

There’s no one-size-fits-all solution. We provide adaptable services that you can change at any time to meet your needs. With our modular services model, you can adjust services according to your business requirements and budget.

In the ever-changing business world, we recognize the difficulties of committing long-term. Unlike other vendors that complicate the transition from their platform, iBenefitsHR offers complete flexibility and freedom to adjust services and move towards independence as your business expands.

/Achieving%20HR.png?width=1024&height=1024&name=Achieving%20HR.png)

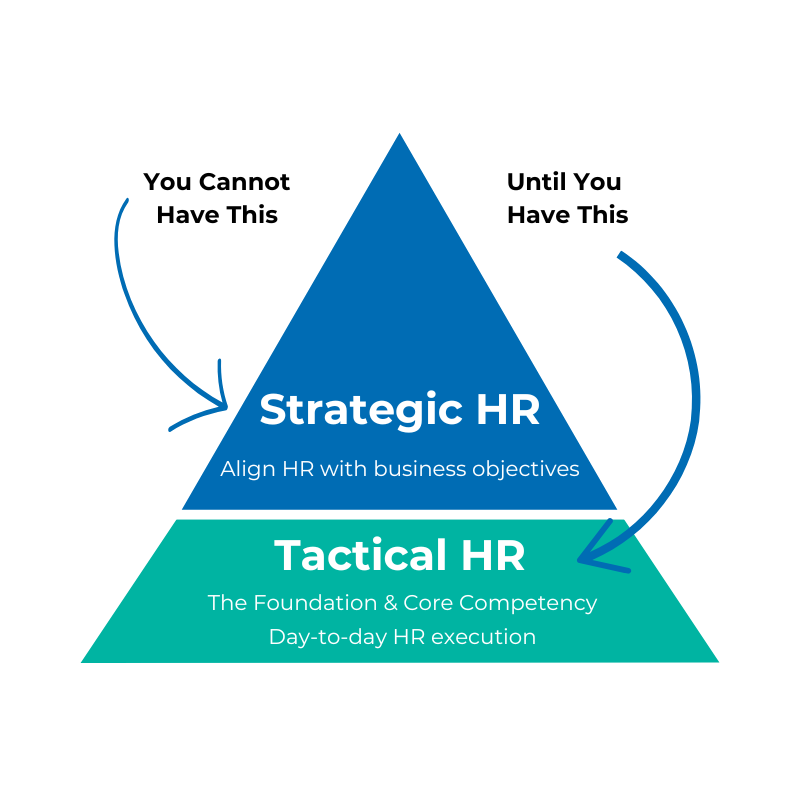

Achieving exceptional HR is simple but not easy

Achieving excellence in any endeavor starts with the fundamentals. However, the fundamentals of HR are spread across a broad spectrum that includes a mix of tactical and strategic components. So, while the fundamentals are not complex, the expertise and skill sets required to master them require a full team of experienced specialists.

GET STARTED

See how we can help you on your path to building an exceptional HR

If you need assistance with human resources, employee benefits, compliance, or payroll, you can customize your HR solution by selecting as many or as few services as you need. Contact one of our HR specialists today to receive a custom quote instantly.

.png?width=1329&height=291&name=iBenefitsHR%20with%20Spectrum%20(blue).png)